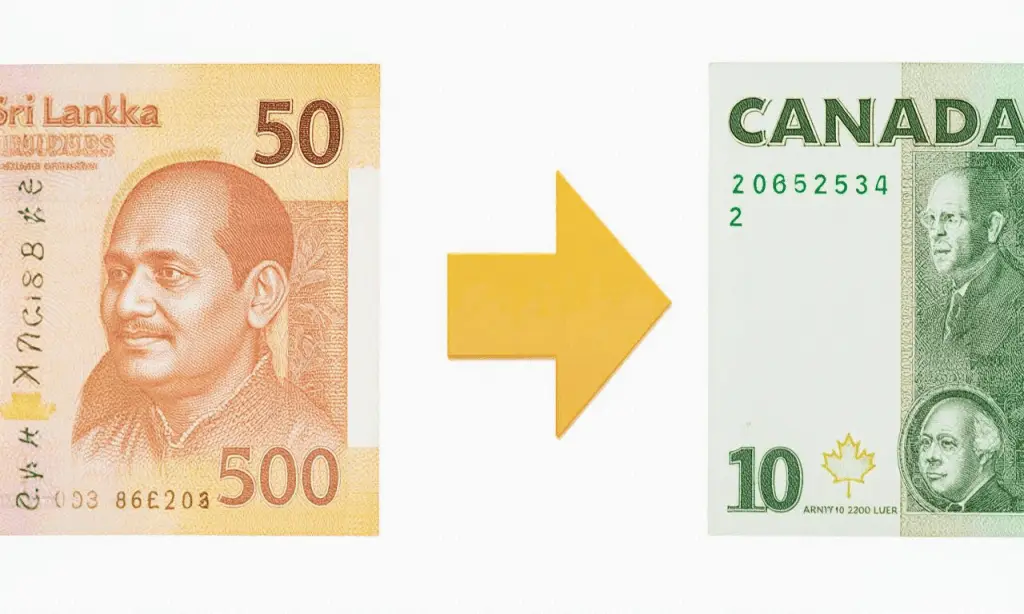

Sri Lanka to Canada Money Transfer: The Tax Avoidance Guide

The global migration of Sri Lankans to Canada has seen a steady increase over the past few decades. As many Sri Lankans settle in Canada, the need for cross-border money transfers becomes even more prominent. Whether it's sending remittances to family members back home or moving money for business investments, the process of transferring funds from Sri Lanka to Canada is a common part of the financial routine for many.

However, with this transfer comes the question of taxes. How can you avoid excessive taxes on the money you send? In this guide, we will discuss key strategies for managing your money transfer to ensure tax efficiency and avoid unnecessary penalties.

Understanding Money Transfer Taxation Between Sri Lanka and Canada

Before diving into the strategies for tax avoidance, it’s essential to understand the basic framework of tax laws governing money transfers from Sri Lanka to Canada.

- Sri Lanka’s Tax Laws: Sri Lanka does not typically impose tax on the money sent abroad as remittances, particularly when it comes from personal sources such as salaries or gifts. However, it is always essential to check the latest updates on any restrictions or regulations on sending large sums of money abroad. You should be aware that transactions above a specific threshold may be subject to reporting requirements, particularly if there is a suspicion of money laundering or illicit activity.

- Canada’s Tax Laws: Canada generally doesn’t tax money transfers between individuals as gifts or remittances, provided that the transfer is made between family members. However, the Canadian government does monitor large sums of money coming into the country to ensure that they are not connected to illegal activities. If you plan on transferring large sums of money (over CAD 10,000), you must report it to the Canadian authorities to avoid penalties.

For example, the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) requires financial institutions to report any transactions that exceed this threshold. Failure to do so may result in a fine or other penalties.

Legal Tax Avoidance Strategies for Money Transfers

While tax avoidance might sound complicated, it simply refers to the process of legally minimizing your tax obligations. Here are some effective strategies to help you manage money transfers from Sri Lanka to Canada while avoiding unnecessary tax burdens:

- Leverage Gift Exemptions: In Canada, individuals can receive a certain amount of money as a gift without incurring any tax liabilities. For example, if you are sending money to a close family member, the transfer could be treated as a non-taxable gift, provided it is not tied to income generation or investment activities.

It’s important to ensure that the money is truly a gift and not a loan, as loans can have different tax implications. Additionally, both the sender and the receiver should maintain clear records that show the transfer was made without any expectations of repayment.

- Use Remittance Services with Lower Fees: The method through which you transfer your money can also have an impact on taxes or hidden fees. Some remittance services charge high fees that could eat into the amount you send. By selecting a service with lower fees, you can ensure that a larger portion of your money is received by your family or beneficiaries in Canada, thus reducing any additional tax-related costs. Some services even allow for transfers with minimal transaction fees or no service charges for certain amounts.

- Minimize Large Transactions: While transferring large sums of money to Canada doesn’t automatically trigger taxes, the amount of money being transferred can raise red flags with financial authorities. To avoid scrutiny, consider breaking down large transfers into smaller amounts. By doing so, you ensure that you stay below the reporting threshold, making it less likely that your transfer will attract attention from tax authorities. However, it's important to remember that repeated smaller transfers could still be flagged if they appear suspicious, so keeping the transfers reasonable is crucial.

- Consider Tax-Advantaged Accounts: If you’re transferring money for investment purposes, consider using tax-advantaged accounts like a Tax-Free Savings Account (TFSA) or Registered Retirement Savings Plan (RRSP) in Canada. These accounts offer tax benefits, such as tax-free growth or deferred taxes, depending on the account type. By using these accounts to hold transferred funds, you can reduce your tax obligations in Canada.

Additionally, certain investment options in Sri Lanka may be available to expatriates that offer tax exemptions, so it’s worth consulting with a financial advisor both in Sri Lanka and Canada to explore these opportunities.

- Use Professional Tax Advisors: One of the best ways to navigate the complexities of international money transfers and taxes is to seek professional advice. Tax consultants or financial planners who specialize in cross-border transactions can provide valuable insight into the most effective strategies to minimize your tax liabilities. They can also help you stay compliant with tax laws in both Sri Lanka and Canada, preventing costly mistakes that could result in penalties.

The Risks of Not Complying with Tax Laws

While it might seem tempting to try to find ways to avoid taxes altogether, there are significant risks involved in non-compliance. Canada has strict regulations about reporting large sums of money entering the country, and failure to adhere to these rules could result in:

- Fines and Penalties: The Canadian government imposes significant penalties on those who fail to report large money transfers. This can include fines, penalties, and even legal action if the transfer is found to be linked to illegal activities or if taxes were evaded.

- Suspicion of Illicit Activities: Large, unreported transfers can raise suspicions of money laundering, terrorist financing, or other illegal activities. This can lead to an investigation and potential freezing of the transferred funds while authorities assess the legitimacy of the transaction.

- Loss of Financial Opportunities: Non-compliance with tax laws can hinder your ability to access various financial services in Canada, such as loans or credit applications. A tainted financial record can make it difficult to obtain a mortgage, car loan, or even set up certain investment accounts.

Conclusion

Transferring money from Sri Lanka to Canada can be a straightforward process if you are aware of the tax laws and take the necessary steps to avoid unnecessary taxes and penalties. By utilizing gift exemptions, leveraging remittance services with lower fees, minimizing large transactions, using tax-advantaged accounts, and seeking professional advice, you can ensure that your money transfer remains smooth and tax-efficient.

It’s always important to stay informed about the latest regulations in both Sri Lanka and Canada, as tax laws are constantly evolving. A well-planned and compliant money transfer strategy will help you avoid any unwanted tax burdens and ensure that your hard-earned money goes further.

Disclaimer:

This article is for informational purposes only and should not be considered as legal or financial advice. Please consult with a tax advisor or financial professional to discuss your specific situation. Taxes are subject to change, and you should always ensure compliance with local and international regulations.